Just when I thought I could not be any more distraught over the sudden passing of Prince Rodgers Nelson, this happened…

Prince died without a will.

I was overwhelmed. Why was I so shocked? As an Inheritance Tax attorney, I knew there were many individuals, including notable celebrities, who died intestate (without a will). But, Prince dying intestate flew in the face of everything we knew about him. It seemed uncharacteristic. I am not the only person that has searched the internet in vain for free Prince music. Even as I begrudgingly entered my iTunes password to enjoy his masterpieces, I respected and admired his shrewd business practices. I could not fathom that he would not handle his personal affairs in the same manner.

No country for privacy in the land of Probate.

In an interview shortly after his passing, a friend mused, “I am not sure if anyone really knew the real Prince, we all loved him, but I don’t know how much we really knew him.” The probate process is a stark contrast to the privacy Prince enjoyed during life.

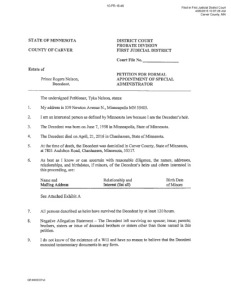

The documents filed by his sister, Tyka Nelson, in Carver County gives a glimpse into how public this will be. Although the value of his estate is listed as “unknown,” the Administrator is required to file an inventory of Prince’s assets and value as of his date of death with the court by January 21, 2017. Minn. Stat. § 524.3-706 (2015). The Administrator also has the responsibility to supplement the inventory if he or she learns of any additional property after filing. Minn. Stat. § 524.3-708 (2015).

The documents filed by his sister, Tyka Nelson, in Carver County gives a glimpse into how public this will be. Although the value of his estate is listed as “unknown,” the Administrator is required to file an inventory of Prince’s assets and value as of his date of death with the court by January 21, 2017. Minn. Stat. § 524.3-706 (2015). The Administrator also has the responsibility to supplement the inventory if he or she learns of any additional property after filing. Minn. Stat. § 524.3-708 (2015).

In contrast, Michael Jackson’s will was filed in Los Angeles County stating that all of his assets went to the Trustees of the “Michael Jackson Family Trust” and he named three co-executors. No additional documents were necessary.

Though fiercely protected in life, Prince’s music is in jeopardy in death.

From a young age, Prince knew the value of control. He demanded that he produce his music. Prince was a fierce protector of his music and artistry. A perfect example of his protection was in 2014 when Prince sued 22 internet users for $22 million for posting live video of his concerts.

During his contract battle with Warner Brothers in the 1990s, Prince changed his name to a symbol to show he couldn’t be controlled. The media responded by calling him, “The Artist Formerly Known as Prince.”

Prince’s protection of his intellectual property during his life could ultimately mean nothing if his Estate is unable to maintain that same level of protection. In an attempt to address this problem, in her Petition For Formal Appointment of Special Administrator, Ms. Nelson stated that Prince “had substantial assets consisting of personal and real property” that required protection and his “owned and controlled business interests” required ongoing supervision and management.

Administering an Estate through the laws of intestacy can be a long process. It is unclear how his business interests are situated, but a search of county records around Minneapolis revealed several properties owned solely in his name totalling over $1,000,000. Although one million dollars is just a small fraction of Prince wealth, it signals some of the thorny legal issues on the horizon.

Under Minnesota law, Prince’s whole blood sister, Tyka Nelson, and five half-siblings have an equal right to his assets. See Minn. Stat. § 524.2-103 (3) and 524.2-107 (2015). It has been almost thirty years since the last Nelson family feud. In 1989, Prince, his father, and brother were engaged in a legal battle with his sister, Lorna, over Prince’s song, “U got the look.” Nelson v. PRN Productions, Inc., 873 F.2d 1141 (8th Cir. Minn. 1989). Family disputes can extend the administration process by years.

Prince’s charitable contributions could stop with his death.

The most profound thing I learned in the days following Prince’s death was the depth and breadth of his philanthropic work. For years, Prince collaborated with philanthropist, Van Jones, on numerous projects, most notably, #yeswecode, which was inspired by Trayvon Martin’s murder. Until 2011, Prince had his own 501(c)(3) charity, Love 4 One Another Charities, credited with donating millions to schools and charities in Los Angeles, Chicago, and New York.

Unfortunately, because there are no provisions of intestacy law which provide for charitable donations, Prince’s work could end with his death.

Even without a will, there’s a possibility that not all of Prince’s assets will go through the Probate process. Two types of assets, joint property with survivorship and assets with beneficiary designations, will not pass through probate. His multitude of business interests could also avoid probate. However, what all of this means for Prince’s estate is still very much uncertain.

Our takeaway. While most of us don’t have as much money as Prince, we know how, and to whom, we want our assets distributed when we die. Make your wishes known by creating a will.