Every evening, the news unceremoniously reports on that day’s stock market performance. The market was up today xyz points. OR The market was down today xyz points. The night of November 22, 2016, the news was more spirited than usual as the market hit a historic high of 19,023.87.

What is the “market”? What are “points”? When it comes to your portfolio, should you care?

The Market

The “market” refers to the Dow Jones Industrial Average (“the Dow”). Arguably, the most watched stock index in the world. It was named for its creators, Charles Dow and Edward Jones, co-founders of the Wall Street Journal. The Dow was created in 1896 as a stock index focused solely on industrials. It has evolved into a barometer of the U.S. economy spanning multiple industries. To keep in line with the changing economy, Dow has had 51 changes since inception. The most recent change happened in early in 2015. The Dow removed AT&T (T), a telecommunications giant with a long history on the index, and replacing it with the tech behemoth, Apple (AAPL).

What’s in the Dow?

The Dow is composed of 30 well-established, high investment quality companies. So it shouldn’t be surprising that the decision makers, the editors of the Wall Street Journal, have chosen industry leaders which include Coca-Cola (KO), Nike (NKE), and Johnson & Johnson (JNJ).

Because the Dow is a price-weighted index, the higher priced stocks, such as Goldman Sachs and Boeing, have greater influence over the value and the movement of the index. The Dow’s early calculations merely added all of the stock prices together on the index and divided by the number of stocks. Voila! The Dow’s value for that day.

The Dow is now too complicated for a simple average to produce an accurate reflection of its value. A traditional average would miss stock mergers and stock splits. If these events were not calculated, the index would be useless. When an event occurs that changes a stock’s value, the Dow divisor (the number used to produce the average) is adjusted to accommodate that change.

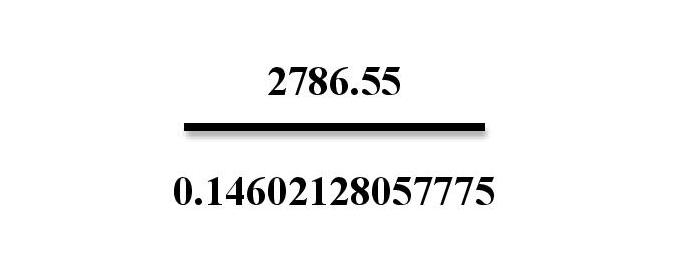

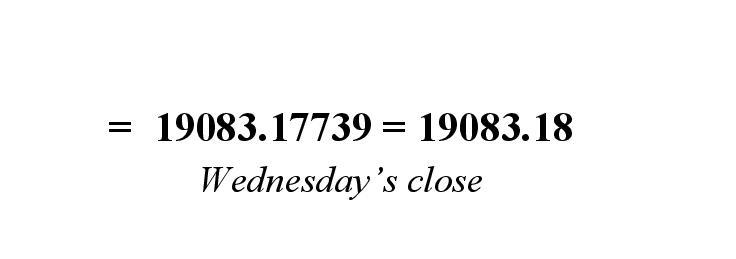

Value of the Dow = (Sum of the shares prices of all 30 of the companies in the index)/Dow Divisor

The current Dow divisor is 0.14602128057775. With a divisor less than one, the Dow’s average will always exceed the total sum of the underlying stocks. Many analysts have said, but for stock splits and other share value reductions, this would be the actual value of the stocks on the index. On Wednesday, November 23, 2016, the Dow closed at 19,083.18.

Points

A point is essentially a number in the index value. The concept of a “point” doesn’t mean much unless it can be effectively used as a measure. Points are usually used to discuss a change in the value of an index.

The Dow closed on Monday, November 21, 2016 at 18,955.90. On Tuesday, November 22, 2016, the market was up 68 points to close at 19,023.87, to finish at its record-breaking high.

19,023.87- 18,955.90= 67.97 = 68

When it comes to your portfolio, should you care about the Dow?

Yes and no. The Dow is a good indicator of the economy. Although it is a good measure of the market’s strength, it’s probably not reflective of your personal portfolio. First, the Dow is only 30 stocks, so it is not representative of the entire market. If you have any mutual funds, your portfolio most likely has exposure to hundreds of stocks. For more accurate view of total market performance, look at the S&P 500, an index that tracks 500 leading companies which covers about 80% of the market.

Second, even if you own some of the stocks represented in the index, your portfolio will not necessarily reflect the gains or losses of the Dow. Remember, the Dow is an “average,” so even with Tuesday’s record high, major players- Pfizer, Visa, Johnson & Johnson, Merck, and IBM- were down.

Third, the market has surged since the Presidential Election. I was caught off guard (see here for my commentary on The Huffington Post) and so were many analysts. The upswing has been lead by just a few industries, banks and companies related to manufacturing and construction.

How can you get in on the fun?

SPDR’s exchange traded fund (ETF), DIA, tracks the Dow. However, since the market is at record highs I’m not advocating purchasing the index right now. Remember, buy low and sell high.

So glad that we were able to recover from the financial disaster in 2007!

Me too! It was a rough time!