In its June 11, 2017, article, Business Insider quipped, “Blue Apron’s IPO is a missed opportunity for Whole Foods.” Not anymore. On Friday, June 16, 2017, Amazon ($AMZN) announced its acquisition of Whole Foods ($WFM) for $13.7 Billion dollars.

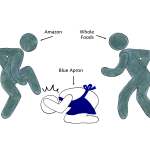

The meal kit industry has two simple components — a subscription service and good food. While Amazon Prime, its subscription service, has no signs of slowing down with over 80 million members; Blue Apron’s subscription service is showing signs of strain. On the other hand, Whole Foods has mastered the art of food. Separately, Amazon and Whole Foods have tried to get into parts of the meal kit industry with no real success. But the combination of two profitable companies signals disaster for unprofitable services like Blue Apron who will be forced to pick up the scraps— if there are any.

The Meal Kit industry

In 2012, meal kit companies burst on the scene as a disruptor to the massive U.S. grocery industry. A food-consulting firm estimated meal kits will account for $3 billion to $5 billion of the online food shopping business in 10 years.

Blue Apron is the leader in this space generating three times the sales of its closest competitor, HelloFresh, and about 12 times the sales of Plated. However, Fast Company’s Sarah Kessler revealed that Blue Apron has a problem- customer retention. Research from the firm 1010data reveals that after the second week, only about 50% of customers stick with Blue Apron. Six months into their subscriptions, only about 10% remain. The firm found a similar pattern for the other major companies in this space.

Although the companies have rejected the 1010data analysis, they have declined to provide accurate data. Based on Blue Apron’s increasing amount of money spent on acquiring new and retaining existing customers, 1010data’s analysis seems correct. In its initial stock registration with the Securities and Exchange Commission, Blue Apron disclosed that they “spend significant amounts on advertising and other marketing activities.. to acquire new customers, retain and engage existing customers, and promote our brand.” Since 2014, dollars spent on marketing has increased from $14 million to $144 million. Even with increases in marketing spend, Blue Apron has yet to report a profit, as of December 31, 2016, it reported a $54 million dollar loss.

A knockout collaboration

Amazon wants to be the first thing any consumer thinks of when they need to buy anything but that’s almost impossible without a grocery component. In the Fall of 2016, Amazon launched Amazon Fresh, a fresh produce and grocery service with delivery to members’ doors. However, the e-commerce giant’s lack of experience in this area showed. It seemed unable to anticipate the scope of the problems—spoilage—that comes with grocery.

Considering the misses its Food Sector was having, Amazon knew the best way to accomplish its overall goal this was to acquire a company with all the right ingredients instead of attempting to develop them. It made good business sense to acquire Whole Foods, one of the most respected brands in the food service industry, a company with a profitable, strong brand and expertise.

The Deal

According to documents filed with the Securities and Exchange Commission, Whole Foods entered into a merger agreement with Amazon. The merger is an all cash deal, meaning shareholders of Whole Foods will receive $42.00 per share (approximately $8.00 more than the stock’s Thursday closing price) instead of shares of Amazon stock. On Friday, June 16, 2017, when the deal was announced, Whole Foods stock was halted until almost 10 a.m. and experienced trading volume 16 times above Thursday’s trading. In Friday’s trading, the price of Whole Foods stock rose slightly above the amount offered in the acquisition. This is the first time Whole Foods stock has been in the $40 range since 2015.

What does this mean for you, the investor?

As of Monday, June 19, 2017, Whole Foods is trading above the buyout price. Good for Whole Foods shareholders, bad for potential buyers. It’s unclear how the stock will perform this week. Frankly, Amazon is still flying high. Would you like to hear more commentary on what this means for the industry? Join me for a webinar at 8 pm on Tuesday, June 20, 2017.