1. Create an emergency account of $1000-$2000.

If you are prepared for an unexpected financial emergency, it’s a mere inconvenience. But if you are unprepared, a financial emergency can take months or years to recover. Many financial experts suggest $1000 in an emergency fund but I’ve personally had one or two emergencies exceed that. I have $2000 in an account that I don’t think about for fear that I will find a crafty way to repurpose the funds for something other than a true emergency.

An emergency fund with octane. My emergency fund is with a Credit Union. For 2015, I received a relationship reward and a dividend, which exceeded what I would have received at a traditional bank. Added bonus, Credit Unions also have amazing interest rates on loans and credit cards.

2. Protect your legacy.

Since my practice area focuses on Estates, I could write a book on the chaos that ensues after someone dies. A will cuts down on the chaos because it provides your instructions to the Executor, the person you select to handle your affairs after you die. Without instructions, your Estate is split under the rules your state. I’d feel some type of way if the government told my family who’s going to take my little red Corvette.

Insurance is the BMW vs. Mercedes Benz debate of personal finance. Insurance should be used to protect against loss, property or life. Not to leave a “legacy.” If you have children under the age of 25, purchase enough term insurance to at least cover your mortgage, car note, and any other miscellaneous bills. Otherwise, a small ($5,000-$20,000) whole life insurance policy should suffice.

Tip. I transferred a sizable life insurance policy from a former employer. Be mindful that there’s a short window to do this after leaving a company. Check with your employer for portability (transfer) options.

How much would it cost to replace everything you own? We don’t think about this until a devastating event occurs. Homeowners insurance. If you own your home, you need to cover your house and the things in it. Renters insurance. If you rent, you still need to cover your belongings. If you have anything of exceptional value- jewelry, watches, furs- you need extra coverage specifically covering those items.

3. Manage your debts.

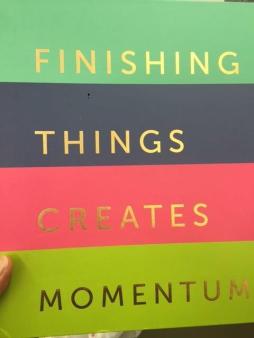

Paying off debt is, by far, the most satisfying thing I have done financially. However, I encourage everyone to have an emergency fund and proper insurance coverage before paying off debt. You cannot fund an emergency or protect your family with a paid off Macy’s charge card. Promise.

I believe in Albert Einstein’s advice, “You have to learn the rules of the game. And then you have to play better than anyone else.” In the game of debt management and credit, it’s important to have a good coach. The Ivy Investor loves The Frugal CrediTnista’s playbook. Check her out at http://mnhcreditsolutions.com!